Most people are surprised when they learn that one million Canadians have filed for Bankruptcy or Consumer Proposal as an insolvency solution in the past ten years.

According to the Office of Superintendent of Bankruptcy (OSB), in the year 2000, a scant 6.4% of Canadian consumer insolvencies were handled via Consumer Proposal. However, as shown in the graph below, by 2015 Consumer Proposal rivalled Bankruptcy, at 47.9% of insolvencies.

Figure 1: Consumer Insolvency in Canada (2006 – 2015) (Source: OCB)

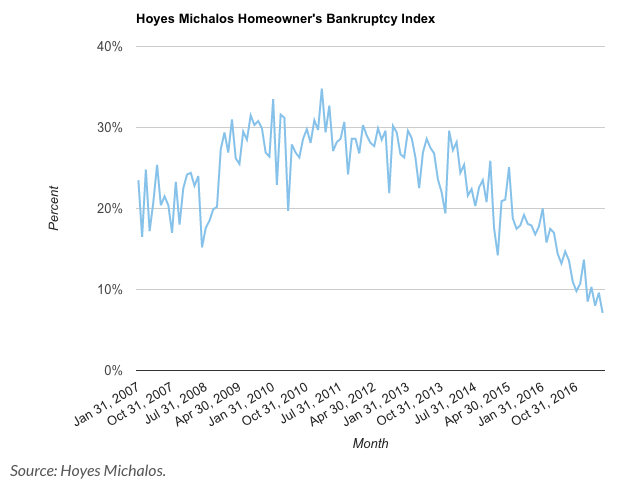

More recent data from the Homeowner Bankruptcy Index shows, the number of people filing for either a consumer proposal or bankruptcy that owned a home fell to just 7% at the end of May 2017.

This is a pretty big drop from the all-time high, when it hit 35% in February 2011. If you look at the chart below, you’ll notice that it drops very rapidly in 2016 and 2017. This was right when home prices across Canada started soaring.

Figure 2: Hoyes Michalos Homeowner’s Bankruptcy Index (January 2007 – December 2016) (Source: Hoyes Michalos)

More and more Canadians are using their homes like ATM machines, withdrawing equity. Homeowners with significant unsecured debt are currently able to refinance this debt through a second mortgage or home equity line of credit (HELOC). There are over two million Canadian’s with a Second Mortgage.

Canadians have been piling on record amounts of debt, and it appears they’re looking for every possible way to delay paying it back. Refinancing your mortgage to consolidate this debt and pay off high-interest credit cards and loans, while keeping the first mortgage in place, is a great way to accommodate this debt.

How Can a Second Mortgage Help You?

A Second Mortgage also known as Private Mortgage, is a charge registered against the title of your home in the second position behind your first or existing mortgage. Often times our Second Mortgages are very easy and simple to qualify for, our lenders will simply confirm that you have enough equity in your home and will forgive you even if you don’t have income, good credit or positive net worth. Most of our second mortgages are approved on an equity basis.

In most major cities in BC, the maximum Loan to Value for BC Second Mortgage financing in today’s market is 75 to 80% of the appraised property value. For example if the home is worth $1,000,000 and the existing first mortgage balance is at 60% of the value($600,000), then the maximum equity that we would be able to access would be $150,000 to $200,000(75% to 80% of $1,000,000 – 60% existing mortgage balance = 15% or 20% equity or $150,000 or $200,000). Private or Second Mortgages make sense when clients do not want to lose their preferred rates on their existing mortgages, or if the prepayment penalties for the existing mortgages are too high, or if the funds are only needed for a short period or to consolidate bills etc.

Is a Second Mortgage right for you? If you are thinking about getting a second mortgage, contact us today.