On April 16, 2024, Finance Minister, Chrystia Freeland introduced the 2024 federal budget. Below are highlights of the key areas of my work – housing and income tax.

Housing

With the ambitious goal of building nearly 3.9 million new homes across Canada by 2031, Budget 2024 proposes to:

- Increase the capital cost allowance rate for apartments from 4% to 10%, allowing builders to increase after-tax returns on investment;

- Extend the mortgage amortization period to 30 years for first-time homebuyers purchasing new builds with less than 20% down;

- Make more public lands available for home construction, including Canada Post and National Defence properties, and lease land to developers;

- Spend $918 million for housing and infrastructure for Indigenous communities;

- Spend $250 million over 2 years to address the “urgent issue” of encampments and a shortage of shelter space for homeless people;

- Plan a national flood insurance program by 2025, providing $15 million to the Canada Mortgage and Housing Corp (CMHC);

- Spend $1.1 billion over 3 years to extend a housing assistance program for asylum claimants.

In my opinion, despite pie-in-the-sky housing goals, extending the mortgage amortization period to 30 years for first-time buyers is a welcome change, however, it won’t move the needle. The program would be more impactful if it were available to everyone – regardless of whether first-time homebuyers are purchasing presale or resale.

The federal government can’t do much on the housing supply side, which is mostly in the hands of provincial and local governments. The decrease in non-permanent residents over the next few years will no doubt have a positive effect on housing demand.

Income taxes

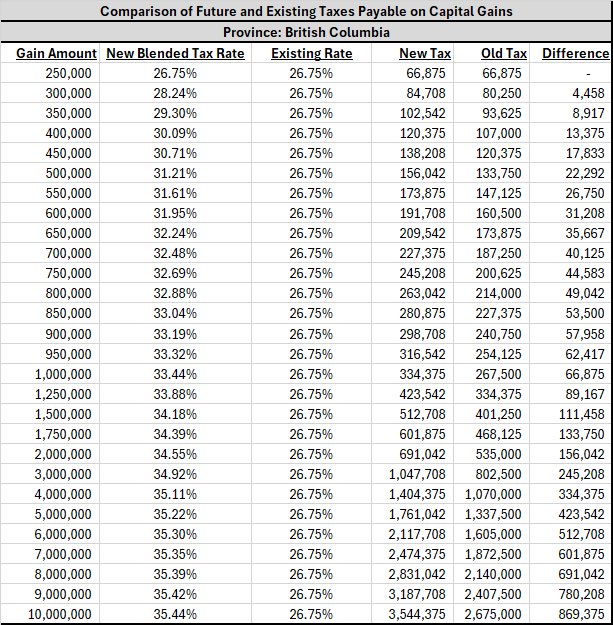

Budget 2024 proposes to increase the capital gains inclusion rate from 50% to 66% on the portion of capital gains realized in the year that exceeds $250,000 for individuals, corporations and trusts, for capital gains realized on or after June 25, 2024. Capital gains from the sale of a principal residence continue to be exempt from tax.

If you purchased a property in BC more than 5 years ago, you would be above the $250,000 cap. If you are selling a rental property in BC, here’s how the increased capital gains taxes would impact you if you were in the top marginal tax bracket.

It could be argued that the capital gains inclusion rate increase could dampen housing formation in the long run if long-term homeowners continue to hold a property for efficient land assemblies.

It’s unlikely that Budget 2024 will derail the Bank of Canada’s plans to cut rates over the coming months, and shouldn’t have an impact on either Canadian interest rates or the Canadian dollar.