The down payment – it’s so often the only thing standing between an otherwise well qualified buyer and a dream home purchase. The question is, how much is necessary? The banks tend to give confusing answers, and it seems that everyone who has purchased over the past few years has a different experience to share. In this post I’ll do my best to demystify the process, although anything that involves the amount of regulation and government oversight that the housing and finance industry does will never be entirely predictable.

What Factors Affect Down Payments?

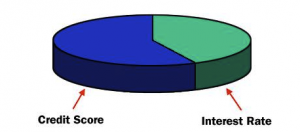

There are two primary variables that affect the relative required value of a down payment: Credit rating and desired interest rate.

By working together with an experienced broker it’s possible well qualified buyers to finance a property purchase with no money down. Twitter followers read about one such mortgage that was closed just last week. To receive ongoing news and updates follow @VancouverBroker. An excellent credit opens a lot of doors that would otherwise be unavailable.

Biggest Down Payment, Smallest Down Payment

That being said, there are solutions to fit nearly any situation. In extreme cases, a down payment of 35% may be required when the applicant’s credit history leads the financial institutions to believe that the loan will be a high risk. Typically down payments of between 10 and 20% will satisfy the requirements of both mortgage insurance lenders to achieve some of the best available interest rates.

If you are able to come up with 35% of the property’s value to be put down up front, the likelihood that you will receive the best possible rate increases to near certainty as you’re walking immediately into a low ration, high equity situation, which is therefore low-risk for the lender. When the down payment in under 10% the lender’s risk stems from the fact that it will be years before there is a significant amount of positive equity in the property that could be used in worst case scenarios.

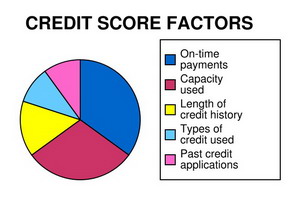

As displayed on the chart above, your credit score is based on a number of factors, some of which can be altered immediately in order to create the best possible scenario for you as a home buyer, others are historical.

How Do I Get My Mortgage Started?

Since each person’s case is unique from the next, the best strategy is to consult with an expert who has achieved results for people with credit ranging from excellent to bankruptcy credit and down payments as low as 0%.

To get a free personalized quote, Apply Here.