Canadian mortgage borrowers are increasingly opting for variable-rate mortgages – a trend that is expected to continue as the Bank of Canada continues to lower interest rates.

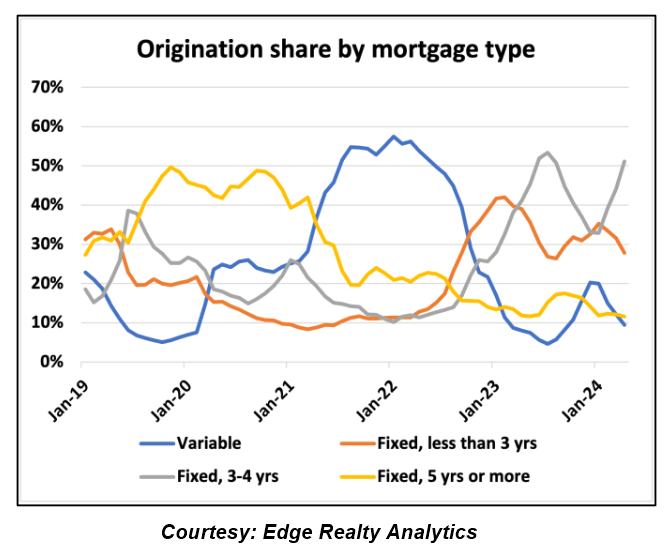

According to the Bank of Canada, as of Q1, 12.9% of new mortgage borrowers opted for a variable-rate mortgage. That’s up from a low of 4.2% reached in Q3 of 2023, but down from a peak of nearly 57% of originations reached during the pandemic when most variable rates were available for less than fixed-rate products.

More recent data show that while the popularity of variable-rate mortgages eased heading into the Spring—and just ahead of the Bank of Canada’s quarter-point rate cut in June—their share of originations is up 50% from a year ago.

Still, variable-rate mortgages are expected to regain a larger share of originations in the months ahead.

I expect that we’ll see an increase in variable originations in the next few months once it becomes clear that the Bank of Canada really is on a serious rate-cutting cycle.

Meanwhile, shorter fixed-rate mortgages are among the most popular choices for today’s borrowers, as they balance shorter-term and competitive rates. More than 50% of new mortgage borrowers selected a 3- or 4-year fixed term in April which was comparable to the same period in 2022.

The Bank of Canada figures also showed that mortgage credit growth reached a 24-year low in the month of just 3.4%.

Before you opt for a variable-rate mortgage, talk to us first.