1. Vancouver real estate will remain extremely desirable for landed immigrants

Let’s face it; everyone wants to live in Vancouver. Scenically, Vancouver is spectacular and you are less than an hour away from mountain or coastal magic. Did I mention hiking, skiing, snowboarding? Vancouver’s economy is also the most vibrant in Canada, if not the world.

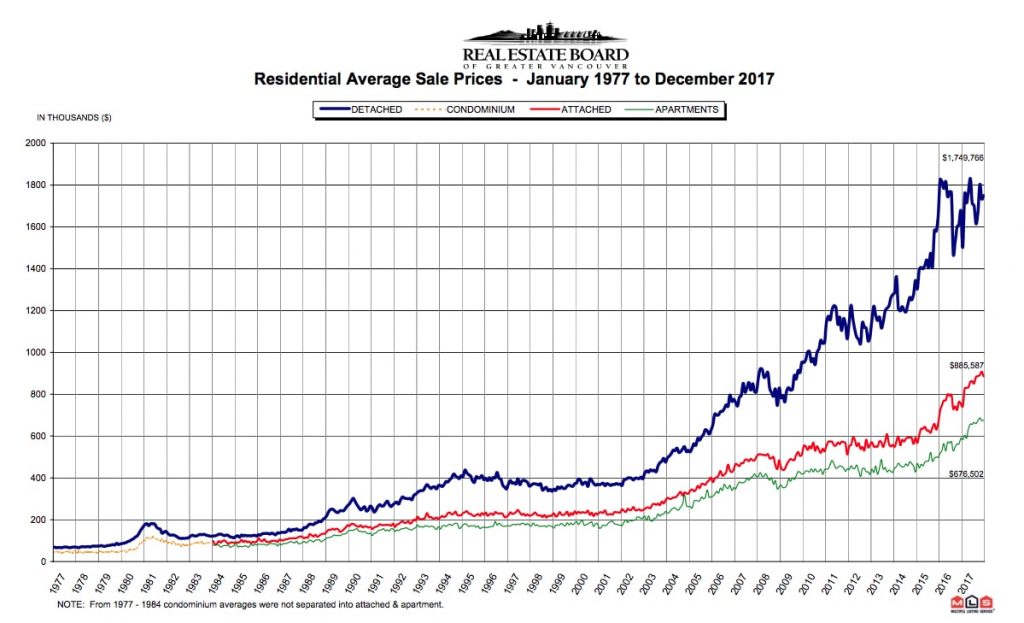

Ever since Vancouver opened itself up to the world at Expo 86, the demand to live here gradually increased year over year, resulting in a surge in property prices.

This year alone, according to data from Statistics Canada, Metro Vancouver, which is home to more than 2.5 million people, has seen sustained population growth thanks to steady immigration from other countries.

2. Bank of Canada interest rates will continue to rise

This past October, the Bank of Canada sent a signal that suggests it will take a more aggressive approach to future hikes than previously expected.

The central bank delivered a quarter-point rate increase for the fifth time since the summer of 2017 —and the first time since July—to bring the benchmark to 1.75%. The rate is now higher than it’s been in about a decade.

Bank of Canada is expected to continue to hike its prime rate in 2019 which will mean instantly higher interest payments for borrowers carrying variable rate mortgages, HELOC’s, and lines of credit.

3. Pre-sales will slow further

Pre-sales of new condominiums are falling and expected to slow further because of the increase in the BC foreign-homebuyer tax to 20% of a property’s value and onerous regulations for investors under BC’s new Condo and Strata Assignment Integrity Register.

Effective January 1, 2019, developers who pre-sell condos must provide the terms of the assignment and the name and social insurance number or business information of the parties to the assignment and report it all to the online register, which forwards the information to the Canada Revenue Agency.

4. Metro Vancouver housing sales will continue to decline

Canada Mortgage and Housing Corp. (CMHC) is expecting Metro region home prices to drop across the board. In its recent housing outlook for BC, the federal housing agency forecast that the composite average home price in the Vancouver Metropolitan Area, which includes much of the Fraser Valley, will decline 9.8% by 2019 and 14% by 2020.

5. Housing supply to increase

BC’s new speculation and vacancy tax will force more sales of houses onto the market in 2019. Vancouver’s empty-home tax is 1% of a home’s assessed value. The BC speculation tax, which covers all of Metro Vancouver, the Victoria capital region, Nanaimo, and most of the central Okanagan, is 0.5% of the property value for Canadian residents and 2% for foreign buyers and satellite families, that is, an individual or spousal unit where the majority of their total worldwide income for the year is not reported on a Canadian tax return.

6. Entry-level condos will remain affordable

With many buyers priced out of the single-family and even townhome market, entry-level condos have gone from very hot to a sort of balanced market situation, so it’s a good time to be a buyer.

With pre-sale demand expected to fall, it might be a good opportunity for local buyers to take a second look at 1 and 2-bed pre-sale units. I anticipate investments being made where buyers see good price and quality.