January jobs report dispells recession fears

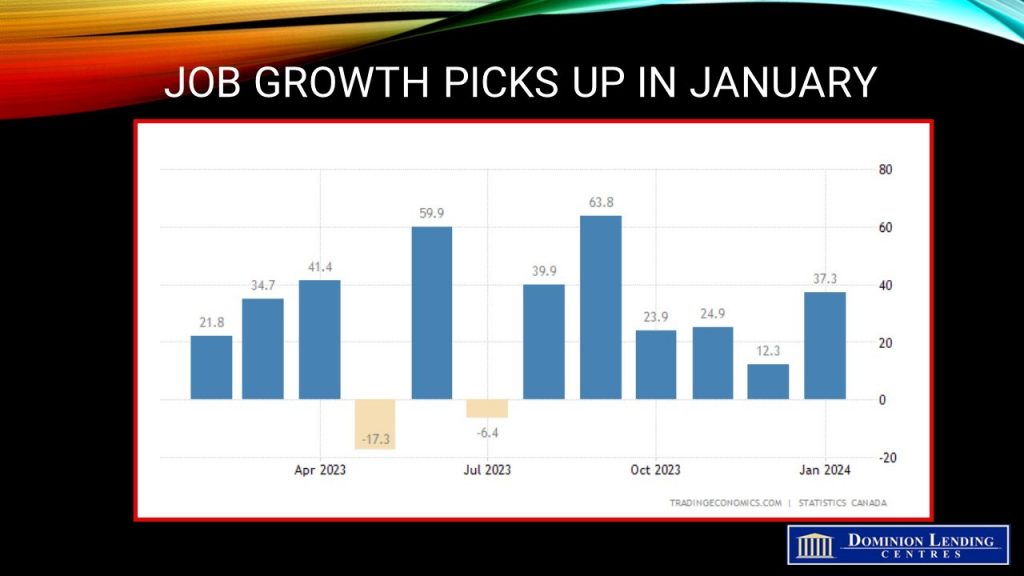

The StatsCanada Labour Force Survey for January was a mixed bag and shows the dramatic effect of surging immigration. Canadian employment rose by a stronger-than-expected 37,300, but part-time jobs rose by 48,900, and in the public sector, the gain was huge. The employment rate fell a tick because population growth outpaced employment growth. The working-age population surged by 125,500 in a single month and is up by a remarkable 1 million adults year-over-year.

This ballooning of the working-age population is without precedent. In the past, it has never grown more than 500,000 in any year. Holy Cow, what are we doing? Where will all of the people live, where will their kids go to school, where will the new hospitals be built, not to mention the transportation infrastructure on already crowded subways and roadways?

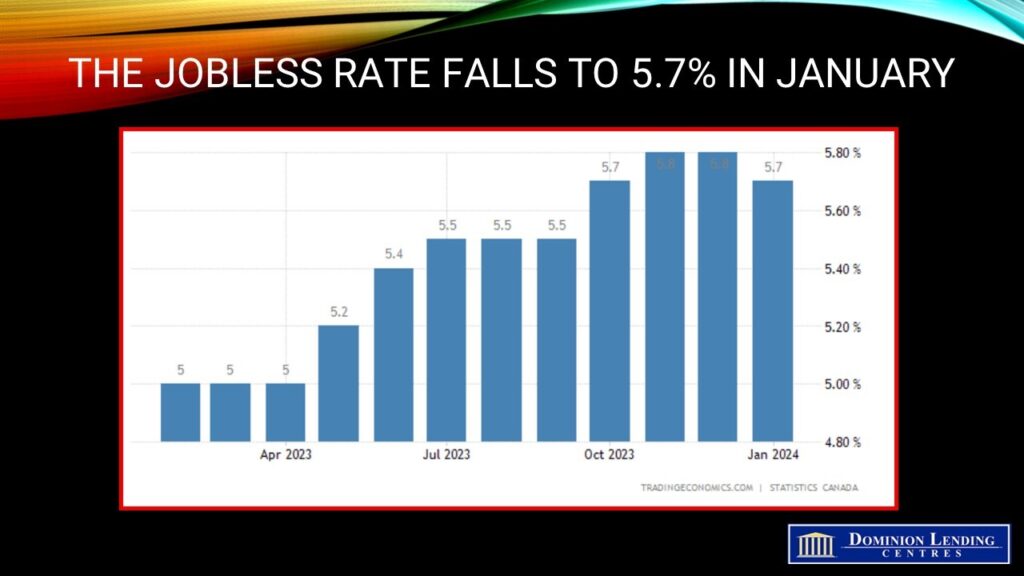

The unemployment rate fell a tick to 5.7%, the first such drop since December 2022. This reflected the 0.2 percentage point decline in the labour force participation love to 65.3%, as the number of people in the labour force held steady and the population rose.

Most of the new jobs were in the service sector, led by wholesale and retail trade, and finance, insurance, real estate, rental and leasing. There were declines in other sectors, especially in accommodation and food services.

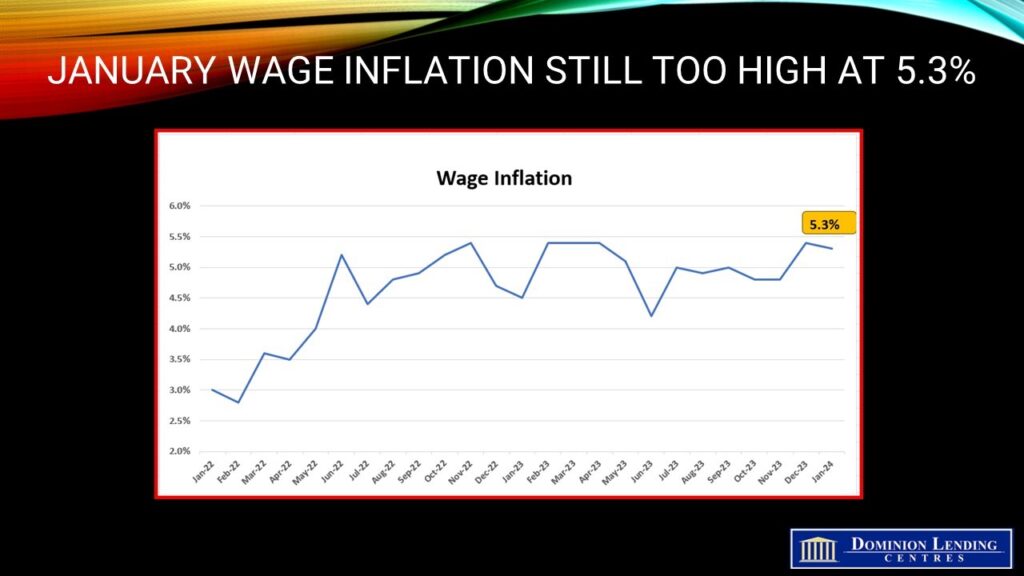

In January, average hourly wages were up 5.3% year-over-year, still way too high for the Bank of Canada. According to Statistics Canada, average hourly wages rose 5.9% to an average of $60.58 for employees with hourly wages in the top 25% of the wage distribution in January 2024, compared with an increase of 4.6% (to $17.64 per hour) for those with hourly wages in the bottom 25% of the wage distribution (not seasonally adjusted). Of course, the highest-paid workers earn a salary and are not paid by the hour.

Bottom Line

The next Bank of Canada announcement date is on March 6th. There is plenty of data yet to come out before then. But judging from what we already know, the economy is not in recession, and wages are still rising too rapidly. Housing markets are already beginning to heat up, and the US economy is running red hot. The strong US inevitably spills into Canada. This gives the BoC more time to ponder inflation. So far, there is no hurry for them to cut rates.

Dr. S Cooper, “Canadian January Jobs Report Suggests No Recession in Sight”, Sherry Cooper, accessed February 12, 2024, https://sherrycooper.com/articles/canadian-january-jobs-report-suggests-no-recession-in-sight/